Some Of Hsmb Advisory Llc

Table of ContentsExcitement About Hsmb Advisory LlcThe Definitive Guide for Hsmb Advisory LlcSome Known Factual Statements About Hsmb Advisory Llc Hsmb Advisory Llc Things To Know Before You Get ThisUnknown Facts About Hsmb Advisory LlcThe Main Principles Of Hsmb Advisory Llc

Ford states to steer clear of "money value or irreversible" life insurance policy, which is even more of an investment than an insurance. "Those are extremely made complex, come with high compensations, and 9 out of 10 individuals don't require them. They're oversold because insurance policy representatives make the biggest compensations on these," he says.

Special needs insurance can be costly. And for those that opt for long-lasting care insurance coverage, this plan might make special needs insurance unneeded.

The Only Guide for Hsmb Advisory Llc

If you have a persistent health issue, this type of insurance coverage could end up being important (Insurance Advise). Nonetheless, don't allow it emphasize you or your checking account early in lifeit's typically best to get a policy in your 50s or 60s with the anticipation that you won't be utilizing it till your 70s or later on.

If you're a small-business owner, think about shielding your source of income by buying business insurance. In the occasion of a disaster-related closure or duration of restoring, business insurance coverage can cover your earnings loss. Think about if a significant weather condition occasion impacted your storefront or manufacturing facilityhow would that affect your earnings?

And also, utilizing insurance could occasionally cost more than it conserves in the long run. If you get a chip in your windscreen, you may consider covering the fixing expenditure with your emergency savings rather of your auto insurance policy. Life Insurance.

All about Hsmb Advisory Llc

Share these tips to secure liked ones from being both underinsured and overinsuredand consult with a trusted expert when required. (https://forums.hostsearch.com/member.php?256834-hsmbadvisory)

Insurance coverage that is purchased by a specific for single-person protection or protection of a family members. The individual pays the costs, rather than employer-based medical insurance where the employer commonly pays a share of the premium. Individuals might shop for and acquisition her response insurance from any kind of strategies available in the individual's geographical region.

People and families might receive financial help to lower the expense of insurance policy premiums and out-of-pocket costs, however just when enrolling through Connect for Health And Wellness Colorado. If you experience particular changes in your life,, you are eligible for a 60-day duration of time where you can enroll in an individual strategy, also if it is beyond the yearly open enrollment duration of Nov.

Hsmb Advisory Llc Fundamentals Explained

- Connect for Health And Wellness Colorado has a full listing of these Qualifying Life Events. Reliant youngsters that are under age 26 are qualified to be consisted of as family members under a parent's protection.

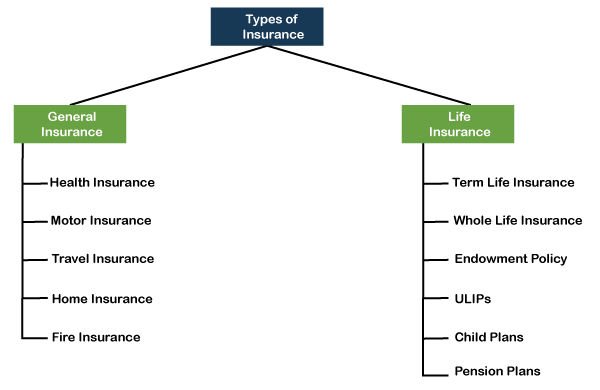

It might appear simple yet recognizing insurance policy kinds can additionally be puzzling. Much of this confusion originates from the insurance coverage market's recurring objective to develop personalized protection for policyholders. In designing versatile policies, there are a selection to select fromand every one of those insurance policy types can make it challenging to recognize what a certain policy is and does.The Facts About Hsmb Advisory Llc Revealed

The best area to begin is to speak about the distinction between both sorts of fundamental life insurance policy: term life insurance policy and irreversible life insurance policy. Term life insurance is life insurance policy that is only active for a time duration. If you die throughout this duration, the person or individuals you have actually named as recipients might get the cash payment of the plan.

However, numerous term life insurance policy plans allow you transform them to an entire life insurance policy plan, so you don't lose coverage. Normally, term life insurance policy plan premium settlements (what you pay monthly or year into your policy) are not secured at the time of purchase, so every five or ten years you have the policy, your premiums could increase.

They additionally have a tendency to be less costly total than entire life, unless you acquire an entire life insurance coverage plan when you're young. There are likewise a couple of variations on term life insurance. One, called group term life insurance, prevails amongst insurance choices you might have access to with your employer.The Definitive Guide to Hsmb Advisory Llc

This is commonly done at no expense to the staff member, with the capability to purchase added insurance coverage that's obtained of the staff member's income. An additional variant that you could have access to via your company is extra life insurance policy (Insurance Advise). Supplemental life insurance coverage might include accidental death and dismemberment (AD&D) insurance policy, or interment insuranceadditional coverage that might help your household in case something unanticipated happens to you.

Long-term life insurance policy merely refers to any life insurance coverage plan that does not run out.